The German National Socialists were in power for 11 years and 7 months. Of that, the peacetime part lasted 5 years and 3 months. The winners, in their own way, have been intensively dealing with that period of history for 80 years. It is mainly a military and political issue, violation of international conventions and solving the racial issue. There is only one aspect of the National Socialist rule left, which is not brought up to date in the media and politics, and that is the German economy. This is strange considering the speed and originality of the solution. The economy is not strictly a party issue for any nation and if something works well, it would be expected that it attracts the attention of other politicians and countries. In the economy, good solutions are by their nature international, something like useful technical achievements. You can find out through the media that Hitler’s government achieved great economic success because it started public works and military production, so that pushed everything forward. One can immediately ask how it is that the USA, which emerged from the war as the winner and the strongest economy in the West, had a significantly slower recovery rate? Also, President Roosevelt initiated public works. Further, why did the powerful American economy experience a complete collapse in peacetime in a country that had all the necessary natural resources? And Germany was a defeated country in political collapse and without basic raw materials, except for coal, which every industry must have.

INTEREST-FREE LOANS FOR CONSTRUCTION

If a young person in Croatia wants to buy an apartment or build a house, they need to go to a bank. There, they will be greeted by an employee who will explain the terms of the loan in a serious voice. On January 18, 2025, this would look like this at Zagrebačka banka:

Apartment area and price per square meter: 55 m, 2,600 euros

Needed loan and interest: 143.500 eura, 106.028 eura

Total to be returned: 249,528 euros

Interest rate in total debt: 73.88 %

Repayment period and monthly installment: 30 years, 692.57 euros

In addition to the total amount of the loan, the costs of real estate valuation, current account management, real estate insurance policy and accident insurance policy of the loan beneficiary should be added.

A ten-year loan for the same amount would be 175,521 euros. The share of interest in the total debt is now lower, 18.21 %, but the monthly installment has increased to 1,459 euros.

This type of lending is presented in the media as inevitable and a result of market conditions. To show social empathy, the government sometimes comes to the aid of young borrowers and participates in part of the loan repayment. This assistance is actually a transfer of state tax revenues from other citizens in order to meet the bank’s lending conditions. And bank revenues are fixed as physical constants and cannot be changed by any higher social interest, such as solving the housing issue for young married couples. Another question is whether it is in the national interest at all for the government to facilitate the construction of apartments in large cities instead of dispersive construction of houses in smaller towns and settlements? Amazingly, this important social issue is not the subject of study at universities, in scientific publications, and in the media. We all know that we should not discuss scientific constants and the profits of private banks. That is why the media makes sure that we deal with climate change caused by man, so there are always fires and floods, the construction of a multiethnic society, etc. Fortunately, our planet is big enough that there is enough such news every evening. Watching other people’s misfortunes from afar always attracts the attention of the average person, although no one will admit to the deeply repressed pleasure that it is happening to someone else, and I am on the soft couch in front of my television, safe, spared from that evil. In contrast to this, after the First World War, a multitude of proposals appeared in the West on how to overcome the shortcomings of a capitalist society based on private profit. Defeated Germany is particularly interesting when it comes to this issue. Thus, in 1922, the Bavarian government proposed a law that would allow interest-free lending in construction, especially in building houses. One of the most persistent promoters of interest-free lending was Gottfried Feder.1

Until the National Socialists came to power, he was the main economic theoretician. Interestingly, right after the party came to power in 1933, Feder was pushed aside. The reasons were probably his overemphasized anti-capitalist attitude.2

If someone in Croatia today were to offer a young married couple a long-term interest-free loan where the borrower would repay only 2% of the principal annually, they would be suspected of being a fraudster. Well, today’s fraudsters don’t even try to sell such a “product” because they know it is too incredible. However, Feder proposed such a solution in Germany. The project leader should not have been the state, but a public company called the Bank for Economic and Social Construction. The proposer believed that the state as the owner would be too inefficient, slow, and that it would be better to leave the business to private initiative, which would retain the role of a supervisory body. Technically speaking, this supervision would be the same as in similar institutions.

The basic idea of the interest-free loan was that the newly created Bank would issue special construction money.3 This money would have to be accepted by every entity. In the event of non-acceptance, the bearer was not obliged to make the payment. On the other hand, the borrower was obliged to repay the bank 2% of the debt annually exclusively in construction money. It is immediately clear that for such a system to function, there must be adequate legal support from the state. Otherwise, if there is no effective legal support, no credit system can function, whether it is state-owned or private banks.

Obtaining a loan, the repayment period and agreeing to the usual terms were a matter of assessment by the Bank’s officers and agreement with the borrower. When a person today reads the terms for such lending, he immediately asks the question: what is the cover for such a loan? Every loan is an emission of money and the creditor must have valid material cover if the borrower does not fulfill its obligations. Otherwise, bankruptcy and inflation in the country will follow. Any uncovered emission of money leads to inflation. The proposed solution is simple. According to the contract, the borrower had to provide land for the house and another 10-30% of the value of the house under construction before receiving the loan. This in itself is a solid sign that this is a borrower with serious intentions, not speculation. This amount includes the Bank’s cost of realizing and implementing the loan in the amount of 5%. From the above, it is clear that the Bank initially has partial mortgage cover for the start of the emission of an interest-free loan. This is money that was emitted from nothing, but has concrete assets and state support behind it. In this way, the state solves the problem of housing and the entire construction industry, which in turn is a powerful driver of the entire economy.

The previous example shows how interest-free loans could be organized in the construction industry. After the National Socialists came to power in 1933, the German government launched a different and even more interesting house-building project. This time, the incentives were aimed at young married couples. The conditions were a secured building site and that the wife did not work, with the explanation that in this way the state was reducing the number of unemployed. Young married couples could receive two types of loans in the amount of 1,000 marks: one was an interest-free loan in the amount of 1,000 RM (Reichsmark)4 for the purchase of furniture, and the monthly installment was 1% of the total loan. The same amount was also used to finance the construction of houses. Their repayment period was 10 years with a low interest rate. The magic of this project is that the borrower was exempted from 25% of the total amount with each newborn child, and with the fourth child the entire loan was automatically liquidated. In this way, from 1933 to 1937, the construction of more than 1,458,179 houses and 91,000 structures belonging to farmers was financed. Houses could not have more than two floors, and they had to have a garden and a yard. Creditors did not support the construction of apartments, and the amount of rent for housing was legally limited to 1/8 of the average worker’s income.5

Foreign journalists immediately began to ask questions and make comments about whether such lending would be inflationary. German officials, who organized such a project, rejected such a possibility. They argued that every married couple with more children must spend much more on their support, food, and clothing, and that in that case they pay taxes to the state on all of this, so their loan is not a pure gift and cannot be inflationary. It is difficult to define such an economic and social project in one word; it was initially a loan with a low interest rate. As the number of family members increased, it was proportionally reduced, and in the end the rest of the loan was given to the borrower as a gift. Practice has confirmed that they were right. The German economy did not experience the usual inflation for capitalist countries until the collapse of 1945.

On this occasion, it is convenient to compare the German and Yugoslav communist housing projects. Unlike the National Socialists, the communists organized the construction and maintenance of apartments through the state. The result was a lot of irrationality, unclear ownership status and manipulation in the allocation process. Apartments were given to those who needed it and those who didn’t. It was usual for its users to turn to the construction of a private house, which had the euphemistic name of a cottage, after getting “for the use of a social apartment”. From an economic point of view, this communist practice was strange. Loans for the construction of private houses were in dinars with a fixed interest in the middle of high inflation, so after a year the loan users thought the best of such a practice, but were dissatisfied when they were greeted by “new prices” of products in stores every day.

Recently, our Hungarian neighbors have begun to successfully implement old German loan project. A female minister from the Swedish government was very annoyed by this policy because, for God’s sake, that’s what the “Nazis” used to do and that’s not right. The Hungarian prime minister endured such criticism for a long time until he had enough, so he publicly and undiplomatically snapped at the Swedish minister to shut up or he would cancel the lease of their fighter jets. What can you call the Swedish minister’s behavior? Who can be bothered by a successful economic and pro-natalist project? What does this project have to do with party interests from the first half of the 20th century? Would the minister condemn the German laws passed by Hitler’s government on the protection of animals and nature and the anti-smoking campaign in the same way? The Swedish minister’s views are an example of political schizophrenia.6 This political pathology has been dominant in Sweden for a long time, in a nation that is demographically dying out and rapidly changing its ethnic composition. Mother Nature would comment on this behavior of their ruling circles: “Well, work on collective suicide if you want to. No one has ever been able to stop individual and collective suicides from carrying out their intentions, but don’t help other nations to be happy in your own way.”

LARGE NATIONAL PROJECTS

Feder suggests completely bypassing private banks when it comes to large projects in energy, transport and post. In this case, the government issues non-credit money. The state would be the organizer, but private contractors. The reasoning is very simple. In this case, the cover for the projects is the fact that they bring large revenues to the state after completion.

In this way, the emission of non-credit money has its own coverage, the price of energy and public transport is freed from the burden of loans and interest. So, everything becomes cheaper, and this is in the general interest. From the point of view of national interests, the construction of a power plant with a loan from private banks with interest is harmful, but from the point of view of private bankers, it is a profitable business with little risk. The question is whose interests have priority.

COUNTRY WITHOUT TAXES

According to the Feder, the main generator of inflation is the issue of interest-bearing loans by private banks. Since such an issue is ubiquitous, interest payments are built into every product. If the burden of interest would disappear, the state would not have to introduce appropriate taxes to pay it off. In this way, the entire economic life would be relieved of a great burden. A welfare state with minimal taxation seems like a utopia, but no one can argue that it is not an interesting solution for the economy in general. The economy of the Federal Republic of Germany after World War II was the most dynamic in Europe. Margrit Kennedy made an effort to research the structure of the price of goods and came to the conclusion that 45% of the price goes to interest payments to the bankers!7

BARTER

Immediately after the National Socialists came to power, Jewish organizations declared economic war, or rather a boycott of the German government. This boycott was unsuccessful because the German government at the time was already trying to bypass private banks as intermediaries everywhere. This also happened in foreign trade by introducing direct commodity exchange (barter, clearing, barter). The Soviet Union successfully applied this practice after World War II.

THE PEOPLE’S CAR “THE BEETLE”

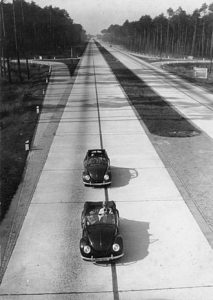

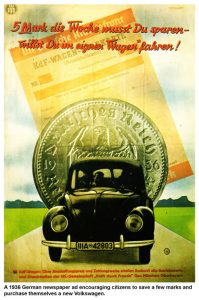

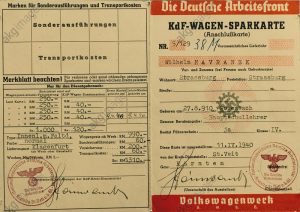

At the beginning of the war in 1939, the German government began to implement a project for a small family car that would be affordable for the people. The offered price of 1,000 RM could not be accepted by any car manufacturer, it was too low and production would be unprofitable. Therefore, the state took on the job. It was a truly original undertaking: instead of the state providing subsidies to the manufacturer to maintain the upper limit of 1,000 RM, future buyers were given the opportunity to finance production. In practice, this meant that buyers had to pay in advance in fixed installments for a certain period of time for the car, and the state committed to a fixed price and delivery date stipulated in the contract. Thus was born the “people’s car” or “beetle”.

“Save five marks every week and you’ll drive your own car.” Such an offer from the government in 1936 must have been very attractive.

This practice is still relevant today. It is in complete contrast to the prevailing card business that encourages consumerism and debt. At first glance, everything looks attractive and most cannot resist this tempting service. Customers, as a rule, only see help here, but they don’t see that card companies and banks make good money from this service because they charge their share through the increased price of each product. Living on debt and spending unearned money is not only an economic issue, but also a wider social psychological issue.

***

When it comes to usury, throughout European history we can only find moral condemnations. This is also the position of the Catholic Church, and then in the 7th century the founder of Islam, the Prophet Muhammad, joined in. Seen from the outside, we can regret that the almighty God of the Quran, in his revelation to the Prophet, did not offer a wise solution to the problem of usury, in addition to condemnation. Because of this omission, Islamic theologians and theorists struggled a lot to build a society that adhered literally to the Quranic text that prohibits usury. The aversion to usury was so widespread among the people that it did not need to be proclaimed as the word of God. All that was needed was a practical solution, and there is none in the Quran or the Bible. Besides, is all interest condemnable? If someone wants to take out a loan with interest to purchase something expensive, then let him do so on the condition that the income from such a loan is directed by the state in the broader social interest. No private banker has any interest and will never have any interest in giving interest-free loans for any purpose. Why would a private person do this, why risk a lot and not profit anything? Only the state can be interested in such projects. At the beginning of XX. century, the relations between capital and labor became so severe that religious and moral condemnations of injustice were not enough. The Bolshevik version of Marxism gained a political foothold in former imperial Russia. Communists started from the basic political dogma that the state, that is, the party, should organize everything in the entire society. Private initiative was thrown out of economic life. The communist concept was at odds with basic human psychology. That’s why, in order to realize their ideas, they needed extremely high levels of violence. It was the most expensive economic-political experiment in history. Economic issues are first of all a political issue, only then a professional issue. Serbian mathematics professor Stojan Nenadovich seems not to have understood this.8 He went so far in his idealism that he wrote to US President Ronald Reagan and his economic advisor Milton Friedman.9

He offered for the American people a better way of monetary policy, which provided for the return to the state of the right to issue non-credit money. In his reply to Nenadović, Friedman pointed out the wrong conclusion, but did not refer to the fact that such a solution worked successfully in a country of 70 million inhabitants. It should be emphasized that the respected Nobel laureate advised President Reagan so well that the last obstacles to financial speculators were demolished during his term. It became a slogan: Gentlemen, get rich! The result was an ever-increasing gambling bubble and the big bang of 2007. Western economists and politicians could not be swayed by the fact that the entire German economic project did not cost the taxpayers or the state anything! In order to understand Germany’s advantages, it is not necessary to graduate from prestigious universities or win the Nobel Prize like Friedman, it is enough to look at the attached pictures. If we look more closely at the data on the car coupons pasted, we will see that in April 1944, they still had the same value of 5 RM per week as before the war.

It should only be remembered that at that time a large part of German cities were in ruins and that everything indicated that they were losing the war. There has been a breakdown in peace in the USA, and great economists continue to persistently explain to us that the cyclical occurrence of crises and constant inflation is a necessary phenomenon in the free market. There is plenty of testimony to support the claim that the German economic solutions were a serious threat to the interests of the big capitalists, above all the Jewish bankers who were at the top of the capitalist pyramid.10 Other sources also confirm that the German economic concept was the main reason for the hostile attitude of the Western countries towards Germany.

Unlike the communists, the National Socialists were much more flexible in their economic policy. They offered an original hybrid economic system that enabled the symbiosis of private ownership and strong state control for the benefit of the community. They did not wage a civil war against private owners in production, but they did try to strictly control the flows of capital. Thus, in a short time, they managed to mitigate the contradictions between capital and labor. Similar to private bankers, private entrepreneurs have no interest in increasing production if they had to hand over all their profits to the state. For the sake of clarity, it is necessary to warn here that the German economic concept of the time would not automatically produce the same results in every country. The German government of the time had at its disposal a people of exceptional working energy, creativity, and discipline. If we were to look for parallels elsewhere after World War II, then it would certainly be China. This country is a good example of how a rigid egalitarian economic concept transformed itself so that it retained a one-party system, macroeconomic control from above, but completely liberated private initiative and creativity from below. In this way, the immense energy that had been restrained in the people until then was released, and the Communist Party of China is channeling this process in the common interest. Ten years ago, it was unthinkable for Western economies to wall themselves off with high tariffs to save their economies from Chinese competition.

In the conditions after the First World War, it was not possible to partially solve economic problems, the solution had to be complete. The National Socialists not only introduced strict control over the movement of capital within Germany, but also outside Germany. This means that capitalist speculators could no longer play with the value of the national currency or invest the capital generated in Germany in various speculative businesses in the world.11

And it is no coincidence that German economic solutions before World War II were completely ignored. Sometimes the explanation is that the German economy was started thanks to large-scale public works and production for the war. Yes, there were large-scale public works, but the secret of their rapid success was in the way they were financed. President Roosevelt also started public works, but they were financed by private banks and everything was more expensive and slower. Only production for the war solved unemployment in the USA. In Germany, this was solved before the armaments were launched. In Germany, this was resolved before the armaments were launched. One of the famous Americans, Thomas Alva Edison, described America’s economic shortcomings in the following way:

„People who will never turn a shovel of dirt or contribute a pound of material will collect more money from the United States than will the people who supply the material and do the work. This is the terrible thing about interest (usury). In all our great bond issues, the interest is always greater than the principal. All the public works cost more than twice the actual cost on that account. Under the present system of doing business (through usury), simply add 100 to 150 percent to the stated cost.“

„But there is a point if our nation can issue a dollar bond, it can issue a dollar bill also. The element that makes the bond good makes the bill good also. If the United States Government will adopt this policy of increasing its natural wealth without contributing to the interest collectors (usurers), – for the whole national debt is made up of interest charges –then you will see unprecedented progress and prosperity in this country.”12

In this text, Edison (1847 -1931) indirectly described the future advantages of the German economy after 1933, when the National Socialists came to power.

Another incorrect assessment regarding the unprecedented inflation in Germany after World War I has been in circulation for a long time. The thesis is that the state was to blame for it because only private bankers know how to do it properly. The head of the German Central Bank claims the opposite in his memoirs. According to him, the Central Bank (Reichbank) was only formally state-owned until 1933, and private bankers played along and created financial chaos.13 Since it was not possible to refute the German results and advantages, the tried and tested tactic of silence or media euthanasia was applied in this case. It is clear to everyone today that the communist project has failed, but the capitalist one is still holding on and its promoters claim that there is no alternative. Big bankers and politicians could not be swayed even by the complete banking collapse of 2007. Admittedly, then they had to call on the help of the state and taxpayers to cover their losses, and again the old way. This means that the practice of investing in currency trading (FOREX) and investing in large financial bets (derivatives) and not in production continued.14 By the way, today’s financial business is so well obscured by “professional” terminology that most people lose the will to follow what it is all about. And the peddlers of banking fog convince us that financing housing construction through private banks is the only alternative and that the only job of the state is to ensure the implementation of such a policy.

No one asks the question anymore why so many Germans today decide to be lifelong tenants?

- Gottfried Feder (1883 – 1941) Engineer and entrepreneur, the party’s main economic theorist. [↩]

- The German State On A National and Socialist Foundation. Copyright 2015. Black House Publishing Ltd. Kemp House 152 City Road. London UK. [↩]

- We call it treasury bills or bonds today. The nominal value of these bonds should have been linked to products such as some metals that have a low price fluctuation over the long term. The Fed gives the example of England where there was a practice that the price of the reference metal was iron. [↩]

- For orientation, the salary of an ordinary worker was 200 – 250 RM, and the first car offered by the German government, later called the Volkswagen or “Beetle”, was worth 1000 RM. If the monthly salary of a worker was 200, then it follows that the “Beetle” was worth five monthly salaries. [↩]

- Stephen Mitford Goodson (1948. – 2018.) Social achivments in the Third Reich 1933 – 1939. The Barnes Review. [↩]

- State Law for the Protection of Animals, Reichstierschutzgesetz and State Law for the Protection of Nature, Reichnaturschutzgesetz, 26 June 1935. The Barnes Review. [↩]

- Margrit Kennedy (1939–2013), German architect, university professor and promoter of interest-free and non-inflationary money. See her text on this website Interest and inflation free money. [↩]

- Stojan Nenadovich (1942 – 2011), high school teacher from Serbia. Wrote and advocated for non-credit money issued by the state. [↩]

- Milton Friedman (1912–2006), descended from a Ukrainian Jewish family, prominent American economist, Nobel Prize winner in 1976. [↩]

- Canadian Dr. Henry Makow refers to a statement given to investigators in 1938 by Christian G. Rakowsky, an associate of Trotsky. This statement was published as a separate work in Serbian, Red Symphony. 1997. Rivel Ko. Belgrade. Henry C. K. Liu. May 24, 2005. Nazism and the German Economic Miracle. Asia Times. The three quotes below are taken from the Internet, published February 11, 2012: Robert Reis, Hitler’s Unforgivable Crime:

American General Robert E. Wood, November 1936, records Churchill’s opinion: “Germany is becoming too strong. We must crush her.”

Lord Robert Boothby (1900–1986), according to Sidney Rogerson’s Propaganda in the Next War (preface to the second edition 2001) February 11, 2012 Churchill makes his basic thesis even clearer: “Before the Second World War, Germany’s unforgivable crime was to try to leave the world trading system, to create its own exchange mechanism and thus take the profits away from the world’s financiers.”

“You must understand that this war is not against Hitler or National Socialism, but against the power of the German people, which must be defeated once and for all, whether Hitler or some Jesuit priest rules there.”

Hasting W. S. Russell (1888 – 1953), Duke of Bedford, British aristocrat, member of the House of Lords, scientist and political arist who advocated reform of the capitalist economic system. The above quote is taken from the Internet: author Axel Hess, National Socialist Economy, November 20, 2011.

“A war between the financiers and the fools… The financiers wanted war as a means of removing their competitors and consolidating even more their enormous power… The German economic solutions were real heresy and if they were allowed to spread, they would expose the whole financial fraud.”

Elliott Roosevelt, son of the American president, As he saw it, DUELL, SLOAN AND PEARCE, New York, 1946, p. 37. “The peace,” said Father firmly, “cannot include any continued despotism. The structure of the peace demands and will get equality of peoples. Equality of peoples involves the utmost freedom of competitive trade. Will anyone suggest that Germany’s attempt to dominate trade in central Europe was not a major contributing factor to war?”

There are other sources that convey the same claims: Joseph P. Kennedy St., the American ambassador to Great Britain before the Second World War, and Neville Chamberlain, the Prime Minister of the British government from V. 1937 to V. 1940. [↩]

- In 1997, prosperous Southeast Asia was gripped by a financial crisis. The then Malaysian Prime Minister Mahathir Mohamad has since persistently claimed that the crisis was artificially caused by capitalist FOREX gamblers. [↩]

- Taken from: Wickliffe B. Vennard, Sr., „The Federal Reserve Hoax – The age of Deception“, p. 138, OMNI PUBLICATIONS, P. O. Box 900566, Palmdale, CA 93590 [↩]

- Hjalmar Schacht (1877 – 1970) German professional banker in the period before 1933 and later Minister of Economy. Interestingly, a non-partisan man was at the head of Rechbank. The Magic of Money. 1967. Oldbourne Book CO. Ltd. 2 Portman St. London W.I. [↩]

- Currency trading (FOREX) exceeds the total production of goods in the world many times over. Financial derivatives are actually a large capitalist casino, the largest betting house in the world. This is where large digital currencies produced by large banks are traded, the stakes are high, and the profits and losses are also high. The consequences for the world economy are not digital but concrete: inflation and the loss of value of money. No one knows exactly what the scale of this favorite capitalist gambling entertainment is. They are popularly called shadow banking. For more information on this topic, see: Ellen H. Brown Web of Debt. (https://www.chinhnghia.com/Web%20of%20Debt%20-%20Ellen%20Brown.pdf). [↩]

No Comment! Be the first one.